Unlock Growth Potential with Innovative Structured Finance Products

In today’s rapidly evolving financial landscape, businesses and investors are constantly seeking advanced solutions to optimize their capital structures, manage risk, and unlock new growth opportunities. One such solution that has gained significant prominence is structured finance products. These financial instruments are designed to address complex financing needs, offering customized approaches that traditional lending cannot always meet.

Structured finance products are not just for large corporations; they also provide valuable opportunities for mid-sized companies, financial institutions, and investors seeking higher returns or improved risk management. Understanding these products and their potential applications can help businesses and individuals make informed financial decisions and achieve their growth ambitions.

What are Structured Finance Products?

Structured finance products refer to a broad category of sophisticated financial instruments that are tailored to meet specific financing requirements. They are typically used when traditional loans or bonds are insufficient or inappropriate due to the complexity, size, or nature of the transaction.

These products work by pooling various financial assets—such as loans, receivables, or mortgages—and then redistributing the risk and cash flows to investors through different tranches or layers. Each tranche carries a different level of risk and return, allowing investors to choose the profile that best suits their investment strategies.

Examples of structured finance products include asset-backed securities (ABS), mortgage-backed securities (MBS), collateralized debt obligations (CDOs), and structured notes. These instruments are particularly popular in sectors like real estate, automotive finance, and infrastructure projects.

Key Types of Structured Finance Products

- Asset-Backed Securities (ABS)

ABS are created by pooling various types of loans—such as auto loans, credit card receivables, or student loans—and issuing securities backed by these assets. Investors receive payments from the cash flow generated by the underlying assets. - Mortgage-Backed Securities (MBS)

Similar to ABS, MBS are securities backed by a pool of residential or commercial mortgages. They played a major role in the real estate finance boom and remain an important investment vehicle today. - Collateralized Debt Obligations (CDOs)

CDOs pool various debt instruments, such as bonds and loans, and repackage them into tranches based on risk and return levels. They are typically used by institutional investors looking to diversify their portfolios. - Structured Notes

Structured notes are hybrid securities that combine fixed-income instruments with derivatives. They offer customized returns linked to the performance of an underlying asset, such as an index, commodity, or currency. - Credit-Linked Notes (CLNs)

CLNs are debt instruments where the repayment is linked to the creditworthiness of a third party. They are often used by banks to manage credit risk exposure.

Benefits of Structured Finance Products

Implementing structured finance products into a financing or investment strategy offers several distinct advantages:

- Customized Solutions

Structured finance is highly flexible, allowing borrowers and investors to tailor the product structure to their specific needs regarding risk, return, and cash flow. - Enhanced Liquidity

By securitizing illiquid assets into tradable securities, businesses can convert non-liquid holdings into immediate cash, improving balance sheet efficiency. - Risk Diversification

Investors can choose from various risk levels within the tranches, allowing them to diversify their investment portfolios according to their risk appetite. - Access to Capital

Companies with non-traditional financing needs or less-than-stellar credit ratings can still access capital markets through structured solutions. - Attractive Returns

Structured finance often provides higher yields than traditional fixed-income investments, making them appealing to yield-seeking investors.

Challenges and Considerations

While structured finance products offer many advantages, they also come with inherent risks and complexities:

- Complexity

Understanding the structure, cash flow waterfalls, and risk profiles of structured products requires a high level of financial expertise. - Market Volatility

Structured products can be sensitive to changes in market conditions, interest rates, and the performance of the underlying assets. - Regulatory Risks

The structured finance market is heavily regulated, and compliance with evolving legal and regulatory standards is crucial. - Credit Risk

If the underlying assets underperform, investors could face significant losses, particularly in lower-rated tranches.

Therefore, businesses and investors should engage experienced advisors, conduct thorough due diligence, and understand the underlying risks before investing in or issuing structured finance products.

Read Also: The Transformative Power of AI Face Swap Technology

The Future of Structured Finance Products

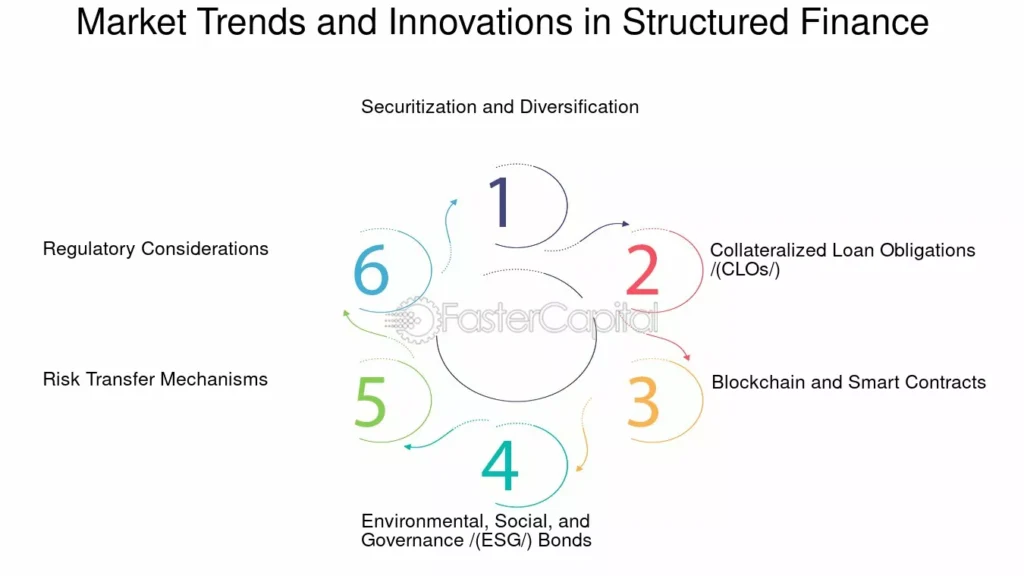

The structured finance market continues to evolve with technological advancements like blockchain, artificial intelligence, and machine learning. These technologies are streamlining the structuring, management, and monitoring of structured finance instruments, increasing transparency, and reducing operational risks.

Additionally, there is a growing emphasis on sustainable finance. Green securitizations and socially responsible investment products are gaining traction, aligning structured finance with environmental, social, and governance (ESG) goals.

Conclusion

Structured finance products have become indispensable tools for businesses seeking innovative ways to raise capital and manage risk. They offer flexibility, liquidity, and opportunities for both issuers and investors. However, their complexity requires careful planning, thorough understanding, and expert guidance. By leveraging the power of structured finance, companies and investors can unlock new growth potential and navigate the complexities of the modern financial world with confidence.