Complete Guide to Cashing Out Your Silver IRA (2025)

Cashing out a Silver IRA requires understanding distribution rules, tax implications, and liquidation processes. For investors aged 59½ or older, distributions avoid early withdrawal penalties. Working with a reputable dealer like Certified Gold Exchange ensures fair market value and simplified processing. Be aware that cash distributions are typically subject to income tax unless from a Roth Silver IRA. Call 800-425-5672 to cash out your gold or silver IRA today.

Understanding Silver IRA Distributions: Key Facts to Cash Out your Silver IRA for 2025

| Distribution Consideration | Details | What You Need to Know |

| Age Requirements | 59½ for penalty-free distributions | 10% early withdrawal penalty if younger |

| Required Minimum Distributions | Begin at age 73 | Failure results in 25% penalty on amount not taken |

| Tax Treatment | Taxed as ordinary income | Traditional IRA distributions are fully taxable |

| Roth Silver IRA | Tax-free qualified distributions | Account must be open 5+ years |

| In-kind Distribution | Physical possession of metals | Still a taxable event based on fair market value |

| Partial Distribution | Take only what you need | Remainder stays tax-advantaged |

Cashing out a Silver IRA represents a significant financial decision that requires careful planning and consideration of numerous factors. The process involves multiple steps and potential tax implications that investors must understand before proceeding. Working with a reputable precious metals dealer like Certified Gold Exchange can substantially simplify this process while ensuring you receive fair market value for your silver assets.

See also: Top Business Loan Schemes for Women Entrepreneurs in India

Reasons to Consider Cashing Out Your Silver IRA

Many investors contemplate liquidating their Silver IRAs for various legitimate reasons in today’s economic environment. Retirement funding needs often drive distribution decisions, particularly for those entering their retirement years who require income for living expenses. The current silver market conditions might present an advantageous selling opportunity for investors who purchased at lower prices and now wish to capitalize on appreciation.

Portfolio rebalancing represents another common motivation, as financial advisors frequently recommend adjusting asset allocations based on changing market conditions and approaching retirement age. Some investors may need funds for significant life events such as medical expenses, home purchases, or educational costs, which qualify for certain penalty exceptions even before age 59½.

Changes in your financial strategy might warrant reconsidering your precious metals holdings, especially if your investment outlook or risk tolerance has evolved. Lastly, required minimum distributions (RMDs) beginning at age 73 necessitate withdrawals from Traditional Silver IRAs according to IRS regulations.

Common Reasons for Silver IRA Distributions:

┌───────────────────────────────────────────────────────┐

│ │

│ Retirement Market Portfolio Financial Required

│ Income Opportunity Rebalancing Needs Distributions

│ │ │ │ │ │

│ │ │ │ │ │

│ └───────────┴─────────────┴────────────┴────────────┘

│ │

│ ▼

│ Silver IRA Distribution

│ │

└───────────────────────────────────────────────────────┘

The Step-by-Step Process for Cashing Out Your Silver IRA

STEP 1: Evaluate Your Distribution Options

| Distribution Type | Description | Best For |

| Total Liquidation | Cash out entire Silver IRA | Complete portfolio restructuring |

| Partial Distribution | Liquidate only a portion | Maintaining some precious metals exposure |

| In-kind Distribution | Take physical possession | Those wanting direct ownership of metals |

| Roth Conversion | Convert to Roth before distribution | Potential tax advantages for some investors |

| 72(t) Distributions | Substantially equal payments | Early retirees before age 59½ |

Before initiating the cashout process, carefully assess your financial needs and determine exactly how much of your Silver IRA you need to liquidate. Consider consulting with a financial advisor to understand how this distribution fits within your broader financial plan and retirement strategy.

STEP 2: Contact Your Silver IRA Custodian

Your IRA custodian serves as the administrator of your self-directed IRA and must be involved in the distribution process. Contact them to:

- Request their specific distribution forms and requirements

- Understand their processing timelines and procedures

- Inquire about any fees associated with distributions

- Determine acceptable methods for liquidating your silver assets

- All of these steps to cash out can be done by a qualified silver dealer

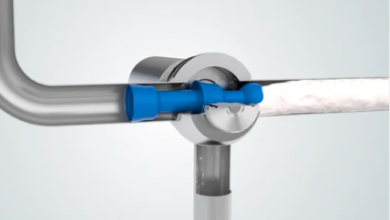

STEP 3: Liquidating Your Silver With Certified Gold Exchange

Show Image

Certified Gold Exchange offers specialized services for Silver IRA liquidations, providing significant advantages over other dealers:

- Competitive Buyback Rates: Typically higher than local dealers or pawn shops

- Streamlined Process: Experienced with IRA custodian requirements

- Direct Custodian Coordination: Handles much of the paperwork and logistics

- Authentication Expertise: Accurate valuation of your silver assets

- Market Timing Guidance: Insight on optimal timing for liquidation

The process typically follows these steps:

- Initial Consultation: Discuss your silver holdings and distribution needs

- Price Quote: Receive current market valuation of your silver assets

- Formal Offer: Written buyback offer for your consideration

- Acceptance: Agree to the terms and price

- Custodian Coordination: Certified Gold Exchange works with your custodian to arrange the transfer

- Settlement: Funds directed according to your instructions (to you or to another investment)

Expert Tip: For the best pricing, contact Certified Gold Exchange when silver spot prices are showing strength. Their market experts can provide guidance on timing your liquidation optimally.

STEP 4: Complete Required Documentation

The distribution process requires proper documentation to satisfy both custodian and IRS requirements:

- Distribution Request Form: Provided by your custodian

- Metals Selection Form: Specifying which silver assets to liquidate

- Tax Withholding Election: Determine if you want taxes withheld

- Delivery Instructions: Where to send the proceeds

- Identification Verification: Government-issued photo ID

STEP 5: Tax Considerations and Reporting

Show Image

All distributions from Traditional Silver IRAs are reported to the IRS and generally subject to income tax. Your custodian will issue a Form 1099-R in January following your distribution year, reporting the total value distributed.

Key Tax Considerations:

| Age/Situation | Tax Treatment | Form |

| Under 59½ | Income tax plus 10% penalty* | 1099-R, 5329 |

| 59½ or older | Income tax only | 1099-R |

| Roth IRA (5+ years, 59½+) | Tax-free qualified distribution | 1099-R (code Q) |

| Required Minimum Distribution | Income tax only | 1099-R |

*Exceptions to the 10% penalty exist for certain situations outlined in IRS Publication 590-B

Consider consulting with a tax professional before taking your distribution to understand the specific tax implications for your situation and explore potential strategies to minimize tax impact.

Special Considerations When Cashing Out a Silver IRA

Market Timing Strategies

Silver prices fluctuate based on various economic factors, potentially affecting the value of your distribution significantly. Consider these market factors when timing your cashout:

- Silver Spot Price Trends: Look for relative strength in the silver market

- Silver-to-Gold Ratio: Historical measure of relative value

- Dollar Strength/Weakness: Silver often moves inversely to the U.S. dollar

- Industrial Demand Forecasts: Silver has significant industrial applications

- Seasonal Patterns: Certain times of year historically show stronger prices

Distribution Alternatives to Consider

| Alternative | How It Works | Potential Benefit |

| Silver-to-Gold Exchange | Convert silver to gold within IRA | Maintain precious metals exposure with different risk profile |

| Partial Distributions | Take only what’s needed annually | Minimize tax impact, maintain some tax-advantaged growth |

| IRA Rollover to Other Assets | Direct transfer to another IRA | Maintain tax-advantaged status |

| Roth Conversion | Convert Traditional to Roth before distribution | Potential long-term tax advantages |

Working With Certified Gold Exchange for Maximum Value

Certified Gold Exchange specializes in precious metals IRA services and offers significant advantages when cashing out your Silver IRA:

- Established reputation with decades in the precious metals industry

- Direct access to wholesale trading desks for better pricing

- Transparent pricing with no hidden fees

- IRA specialists who understand the unique requirements

- Streamlined processing reducing delays and complications

- Authentication expertise ensuring accurate valuation

Conclusion: Maximizing Your Silver IRA Distribution

Cashing out your Silver IRA represents an important financial decision requiring careful planning and consideration. Working with a reputable dealer like Certified Gold Exchange ensures you receive fair market value for your silver while navigating the process efficiently. Understanding the tax implications and timing considerations helps optimize the value of your distribution.

For personalized assistance with your Silver IRA distribution, contact Certified Gold Exchange at 800-300-0715 for a confidential consultation and a live quote for your silver. Their specialists will guide you through the process of cashing out your silver IRA, coordinate with your custodian, and ensure you receive maximum value for your precious metals.

Disclaimer: This guide provides general information and should not be construed as financial, tax, or legal advice. Consult with appropriate professionals regarding your specific situation before making financial decisions.